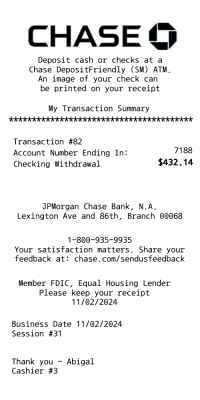

Chase bank statement template

Create a Chase bank statement receipt with our receipt generator. Select the Chase bank statement template from the template library. Edit and customize the receipt. Instantly save and download your customized receipt.

What are the reasons you might need a receipt from Chase bank statement ?

- Proof of purchase for returns or exchanges - Record of transaction for budgeting and financial planning - Verification of charges for tax purposes - Evidence of payment for disputes or discrepancies - Required documentation for reimbursement or expense reports - Necessary for warranty or insurance claims - Helpful for tracking spending habits and budgeting - May be required for proof of payment for rental or leasing agreements - Useful for getting maximum resale value on secondary marketplaces or consignment shops for clothing, shoes, or other retail purchases.

What products are made by Chase bank statement and where are they sold?

Products Made by Chase Bank Statement

- Checking Accounts

- Savings Accounts

- Credit Cards

- Mortgages

- Auto Loans

- Personal Loans

- Investment Products (such as stocks, bonds, and mutual funds)

- Retirement Accounts (such as IRAs and 401(k)s)

- Business Accounts (such as business checking and credit cards)

- Merchant Services (for businesses to accept credit and debit card payments)

- Online and Mobile Banking

- Chase Pay (mobile wallet for making purchases)

- Chase QuickPay (peer-to-peer payment service)

These products are sold by Chase Bank at their physical branches, through their website, and through their mobile app. They may also be sold through third-party retailers, such as credit card comparison websites.

What is the return policy without a receipt at Chase bank statement ?

According to Chase bank's return policy, customers may return items without a receipt under certain conditions:

- The item must be returned within 90 days of the purchase date.

- The item must be in its original condition and packaging.

- The customer must provide a valid photo ID.

- The return must be processed at a Chase bank branch.

If the return is approved, the customer will receive a credit to their account or a cash refund, depending on the original form of payment.

However, please note that certain items may not be eligible for return without a receipt, such as gift cards, personalized items, and opened software.

If you have any further questions or concerns, please contact your nearest Chase bank branch for assistance.

How can I get a duplicate receipt from Chase bank statement ?

How to Get a Duplicate Receipt from Chase Bank Statement

- Log in to your Chase online banking account.

- Click on the "Statements & Documents" tab.

- Select the account for which you need a duplicate receipt.

- Choose the statement period for which you need a receipt.

- Click on the "Download" button.

- Open the downloaded statement in PDF format.

- Scroll through the statement to find the transaction for which you need a receipt.

- Print the page containing the transaction details.

If you are unable to access your online banking account, you can also request a duplicate receipt by calling Chase customer service or visiting a local branch. You may be asked to provide the following information:

- Your full name and account number.

- Date and amount of the transaction for which you need a receipt.

- Reason for requesting a duplicate receipt.

Please note that there may be a fee for requesting a duplicate receipt from Chase bank.

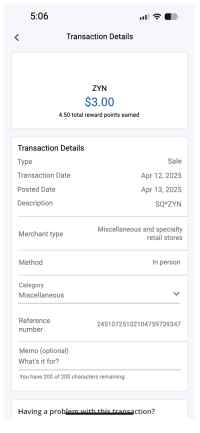

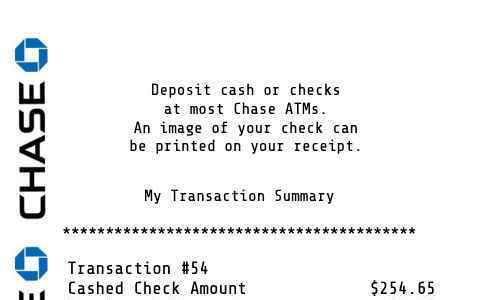

What elements are typically shown on a Chase bank statement receipt.

Chase Bank Statement Receipt

- Date: The date the receipt was printed

- Transaction Description: A brief description of the transaction

- Transaction Amount: The amount of the transaction

- Account Number: The account number associated with the transaction

- Merchant Name: The name of the merchant where the transaction took place

- Transaction Type: Whether the transaction was a debit or credit

- Reference Number: A unique number assigned to the transaction for tracking purposes

- Ending Balance: The account's balance after the transaction

- Branch Information: The location of the Chase branch where the transaction was made

Additional interesting features of a Chase bank statement receipt include:

- QR Code: Some Chase bank receipts may include a QR code, which can be scanned to quickly access more information about the transaction

- Customer Service Information: The receipt may include contact information for Chase customer service, in case of any questions or concerns about the transaction

- Promotions: Some receipts may include promotional offers or discounts for other Chase products or services

- Rewards Points: If the transaction was made using a Chase rewards credit card, the receipt may show how many rewards points were earned from the transaction