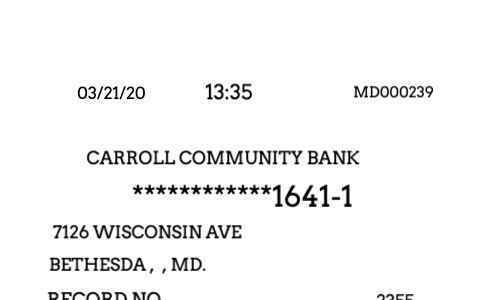

DBS receipt payment bank

Create a DBS payment bank receipt with our receipt generator. Select the DBS receipt payment bank from the template library. Edit and customize the receipt. Instantly save and download your customized receipt.

What are the reasons you might need a receipt from DBS payment bank?

- Proof of purchase for warranty claims or returns - Record of expenses for budgeting or tax purposes - Evidence of payment for reimbursement or expense reports - Documentation for business or personal transactions - Proof of payment for insurance claims - Verification of payment for subscription services or memberships - Proof of payment for rental agreements or lease agreements - Record of purchase for inventory or stock management - Proof of payment for credit card or loan payments - Useful for getting maximum resale value on secondary marketplaces or consignment shops (for clothing, shoes, or other retail purchases)

What products are made by DBS payment bank and where are they sold?

Products made by DBS Payment Bank:

- Basic Savings Account

- Fixed Deposits

- Recurring Deposits

- Current Account

- Debit and ATM Cards

- Online Banking Services

- Mobile Banking Services

These products are primarily sold in India, where DBS Payment Bank operates. However, some of these products may also be available to customers in other countries through online banking services.

What is the return policy without a receipt at DBS payment bank?

Return Policy at DBS Payment Bank without a Receipt

- DBS Payment Bank offers a hassle-free return policy for customers who have lost or misplaced their receipt.

- Customers can return the product within a specified time frame, usually within 14 days from the date of purchase.

- The product must be in its original condition and packaging for the return to be accepted.

- Proof of purchase, such as a bank statement or credit card statement, may be required for the return to be processed.

- If the product is found to be defective or damaged, the return will be accepted and a full refund or replacement will be provided.

- If the product is not defective or damaged, the return may be subject to a restocking fee.

- DBS Payment Bank reserves the right to refuse a return without a receipt if the customer has a history of excessive returns.

- In case of a return without a receipt, the refund will be issued in the form of store credit or a gift card.

- Return shipping costs may be the responsibility of the customer in some cases.

- For further assistance with returns without a receipt, customers can contact DBS Payment Bank's customer service team.

How can I get a duplicate receipt from DBS payment bank?

To obtain a duplicate receipt from DBS payment bank, you can follow these steps: 1. Log in to your DBS payment bank account. 2. Navigate to the transaction history or statement section. 3. Locate the transaction for which you need a duplicate receipt. 4. Click on the transaction to open the details. 5. Look for an option to download or print the receipt. This may vary depending on the platform you are using. 6. If you cannot find the option to download or print the receipt, you can contact DBS customer service for assistance. 7. Provide the necessary details such as the transaction date, amount, and transaction reference number to the customer service representative. 8. They will be able to provide you with a duplicate receipt either via email or by mail. 9. Alternatively, you can also visit a DBS branch and request for a duplicate receipt in person. 10. Keep the duplicate receipt in a safe place for your records.

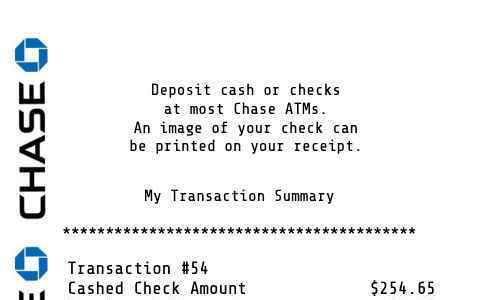

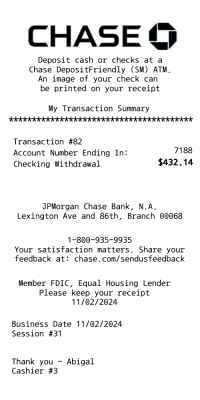

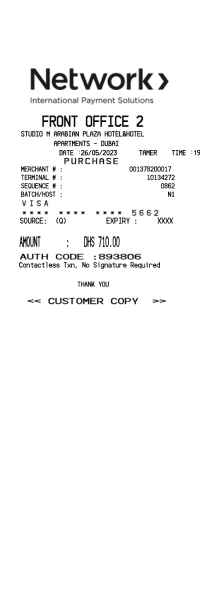

What elements are typically shown on a DBS payment bank receipt.

DBS Payment Bank Receipt

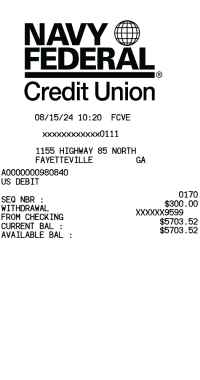

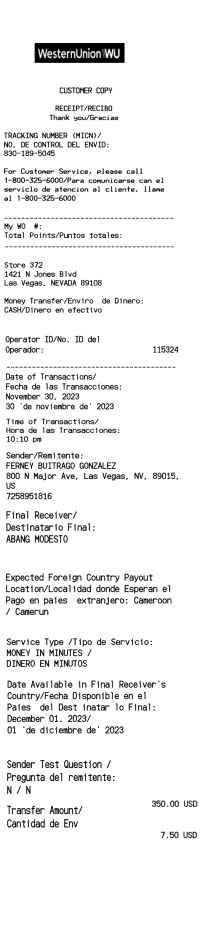

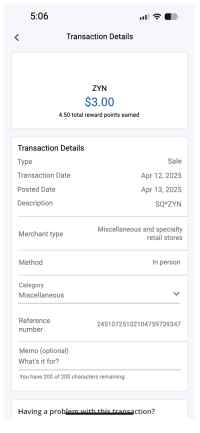

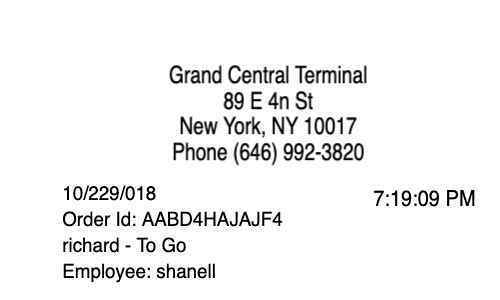

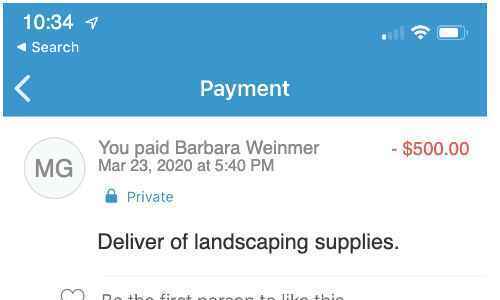

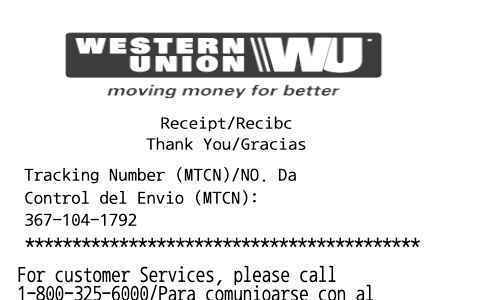

- Date and time of transaction

- Transaction reference number

- Recipient's name and account number

- Amount transferred

- Transaction type (e.g. transfer, payment, etc.)

- Sender's account number

- Sender's name (if available)

- Transaction description (optional)

- Receipt number

- Signature of bank teller (if collected in person)

Additional interesting features of a DBS Payment Bank Receipt:

- Option to receive the receipt via email or SMS

- Ability to view and download receipts online through internet banking

- Detailed breakdown of fees and charges (if applicable)

- Clear indication of foreign currency exchange rates (if applicable)

- Option to print multiple copies for record-keeping purposes