Restaurant template includes VAT

Create a Restaurant includes VAT receipt with our receipt generator. Select the Restaurant template includes VAT from the template library. Edit and customize the receipt. Instantly save and download your customized receipt.

What are the reasons you might need a receipt from Restaurant includes VAT?

• To prove a purchase was made and to show the amount paid.

• To provide evidence of a tax-deductible business expense.

• To provide proof of payment for insurance purposes.

• To track expenses for budgeting.

• To have a record of the item purchased for future reference.

• To obtain a refund or exchange from the restaurant.

• To get maximum resale value on secondary marketplaces or consignment shops.

What products are made by Restaurant includes VAT and where are they sold?

Restaurant Products typically include food and beverages, such as appetizers, entrees, desserts, drinks, and alcoholic beverages. They are usually sold in restaurants, bars, hotels, and other hospitality venues. Depending on the jurisdiction, certain products may also include Value Added Tax (VAT) or other taxes.

What is the return policy without a receipt at Restaurant includes VAT?

Without a receipt, the return policy at a restaurant would depend on the specific restaurant. You should contact the restaurant directly to inquire about their return policy.

How can I get a duplicate receipt from Restaurant includes VAT?

If you need a duplicate receipt from a restaurant that includes VAT, you should contact the restaurant directly and explain your request. The restaurant should be able to provide a duplicate receipt with the correct VAT information.

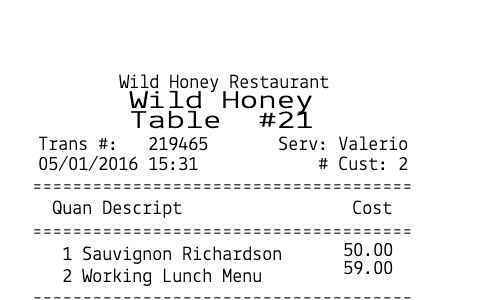

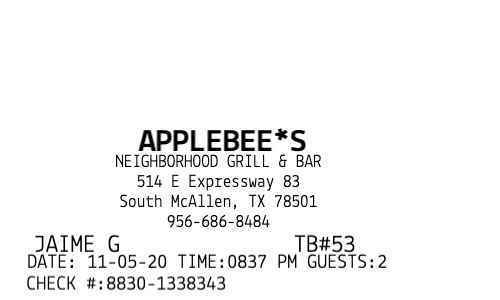

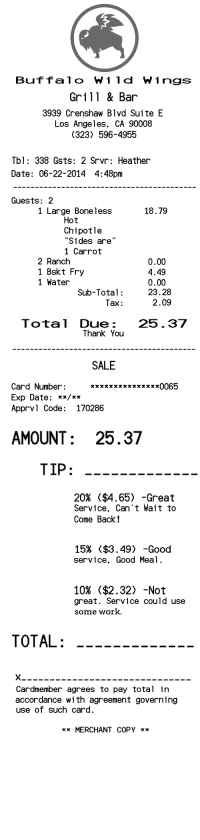

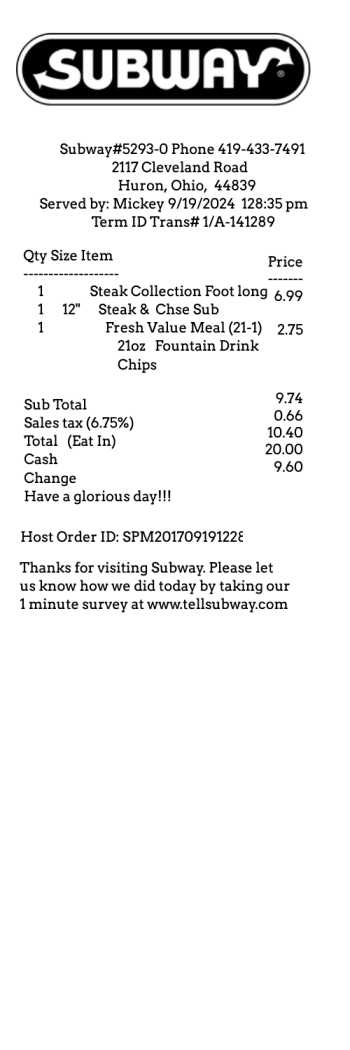

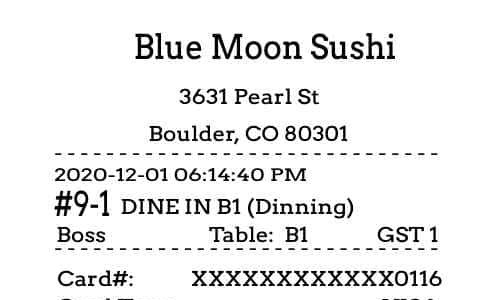

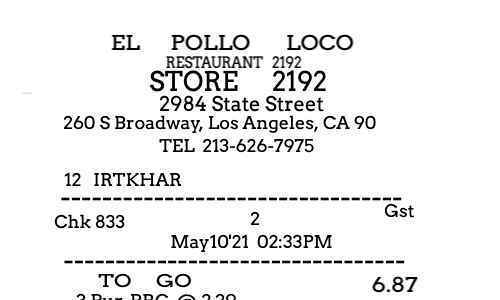

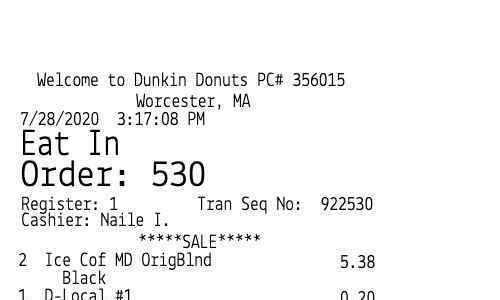

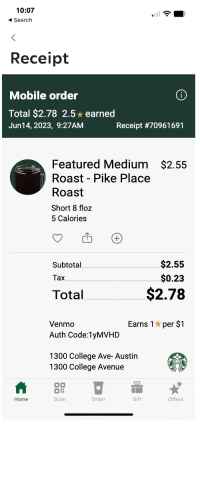

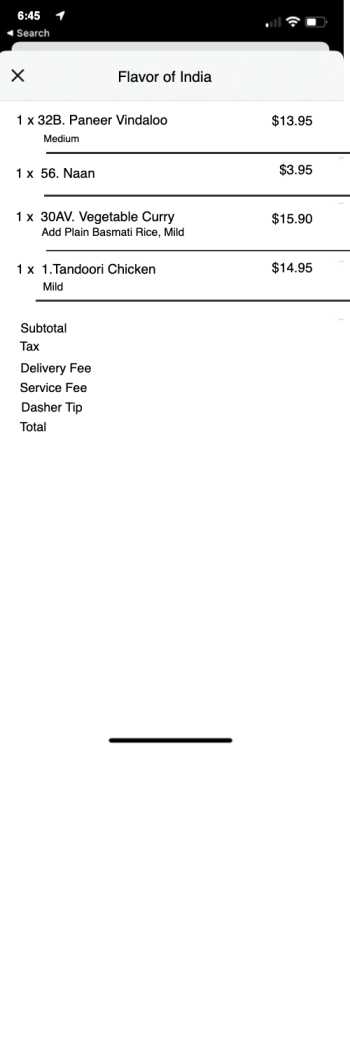

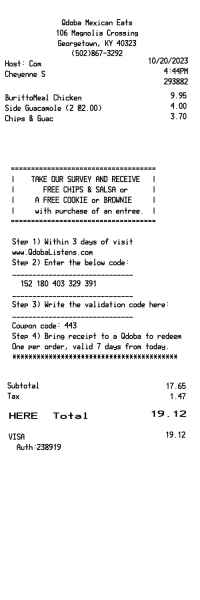

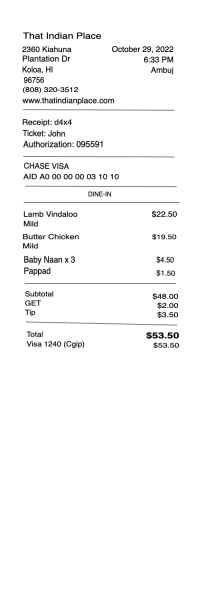

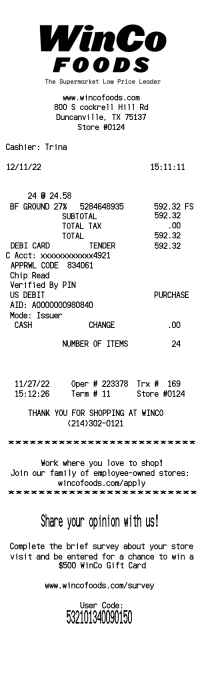

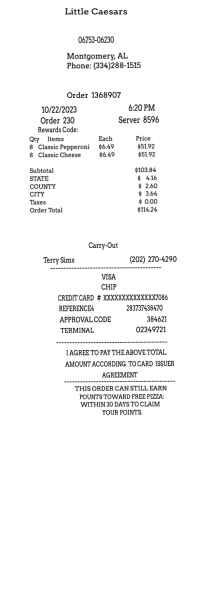

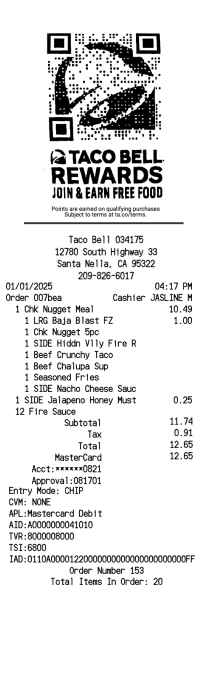

What elements are typically shown on a Restaurant includes VAT receipt.

The elements of a restaurant receipt typically include:

- Name of the restaurant

- Date and time of the transaction

- List of items purchased

- Total cost of goods

- Tax rate and amount of tax paid

- Payment method

- Any discounts or promotions applied Additional interesting features of a restaurant receipt that includes VAT (Value Added Tax) may include:

- VAT registration number

- Breakdown of VAT charged on each item

- Grand total including VAT

- Any other applicable taxes or charges.